Our Philosophy

Portfolio design should be simple, efficient, and cost-effective for every client.

We believe that the market provides sufficient returns for investors with a long-term time horizon, and that attempting to consistently outperform the market is ineffective for sustained growth.

We believe our clients benefit most from a focus on risk management, tax efficiency, liquidity, and total cost reduction in their portfolios.

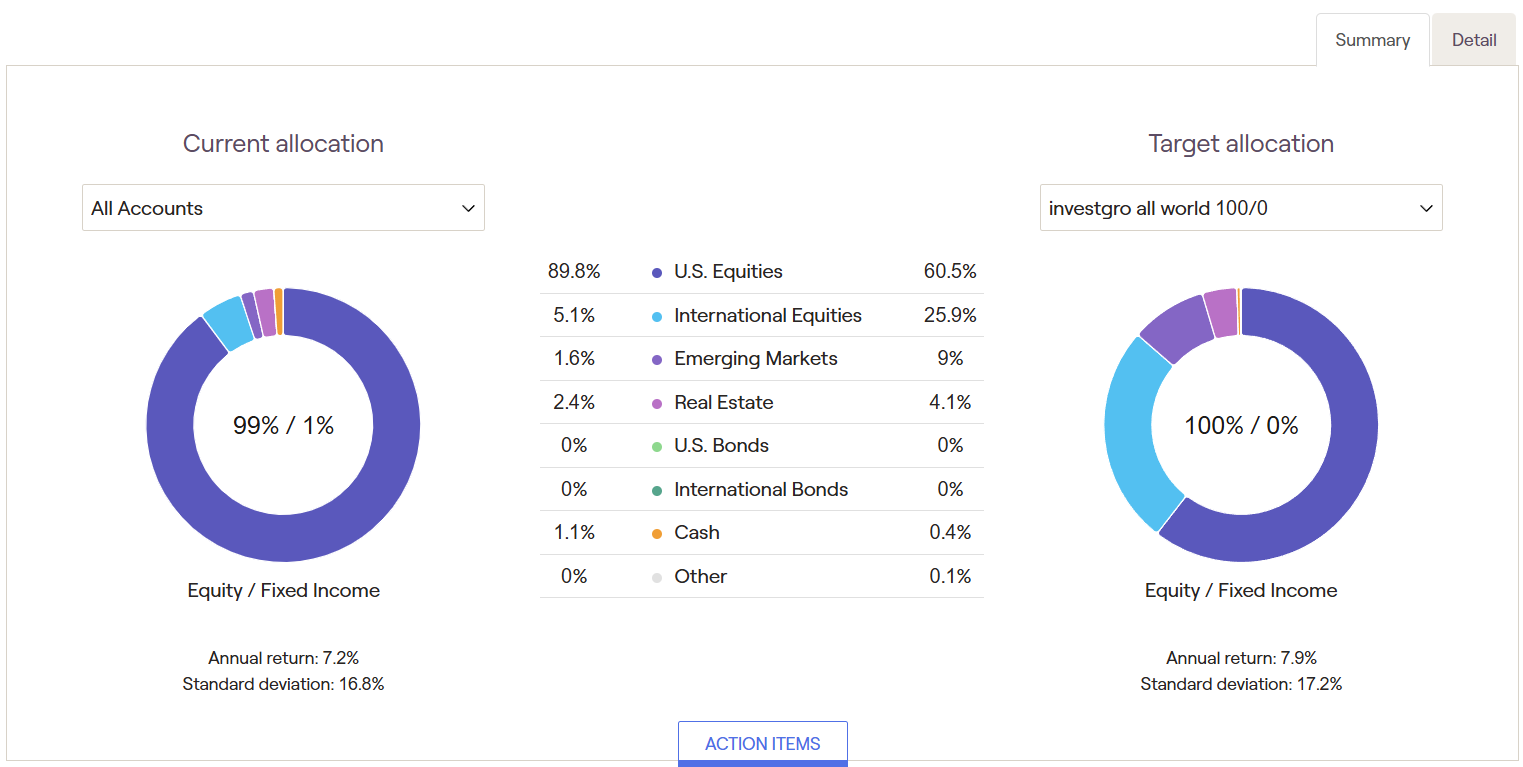

For this reason, we help clients invest in passive investment vehicles, rather than actively managed mutual funds, to maximize market opportunities with broad international diversification at the lowest costs.

How do we find our clients their perfect-fit portfolio?

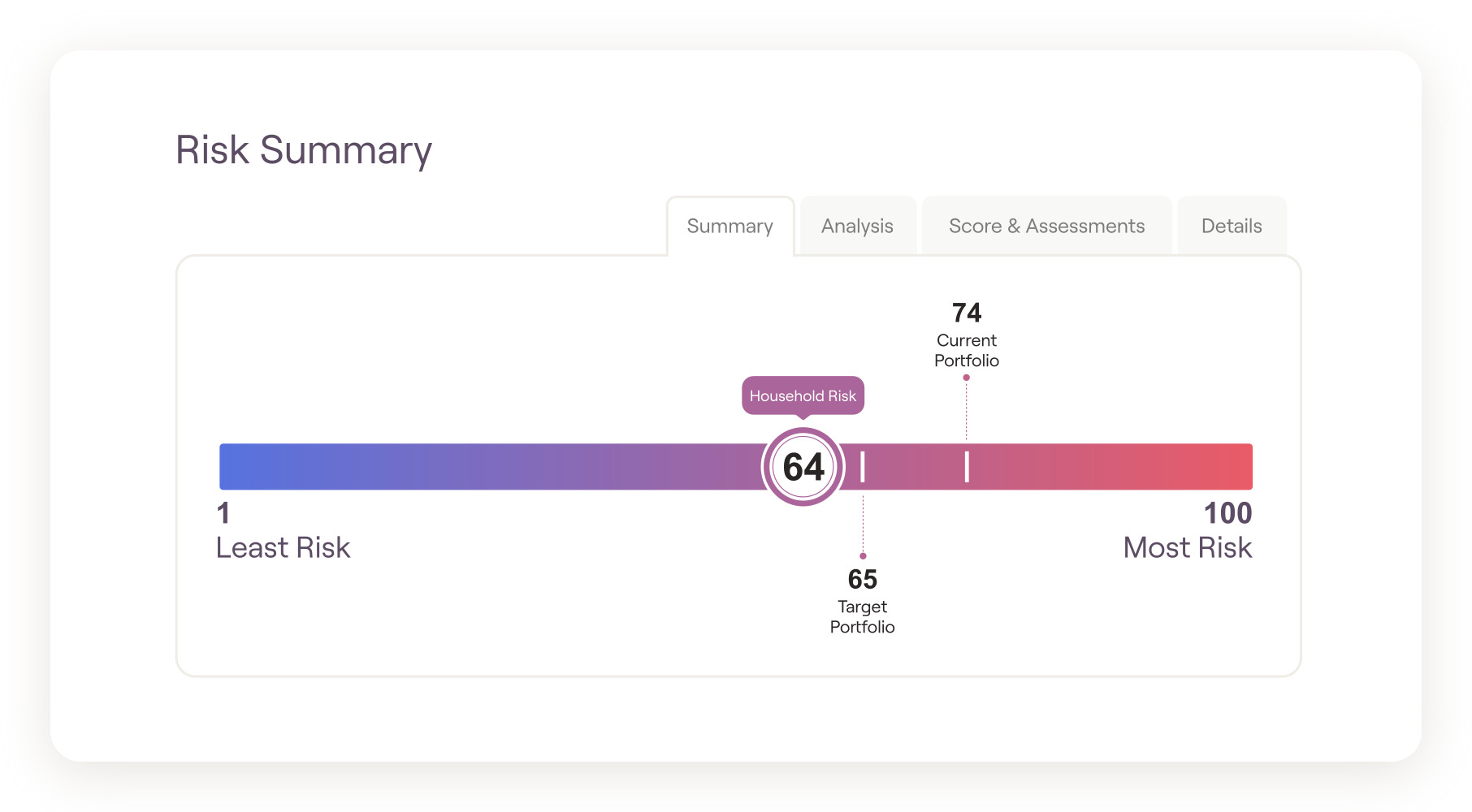

We analyze each client’s portfolio in relation to their personal risk tolerance to maximize returns while minimizing risk.

We then select the optimal mix of investments to achieve the best results within the desired risk profile.

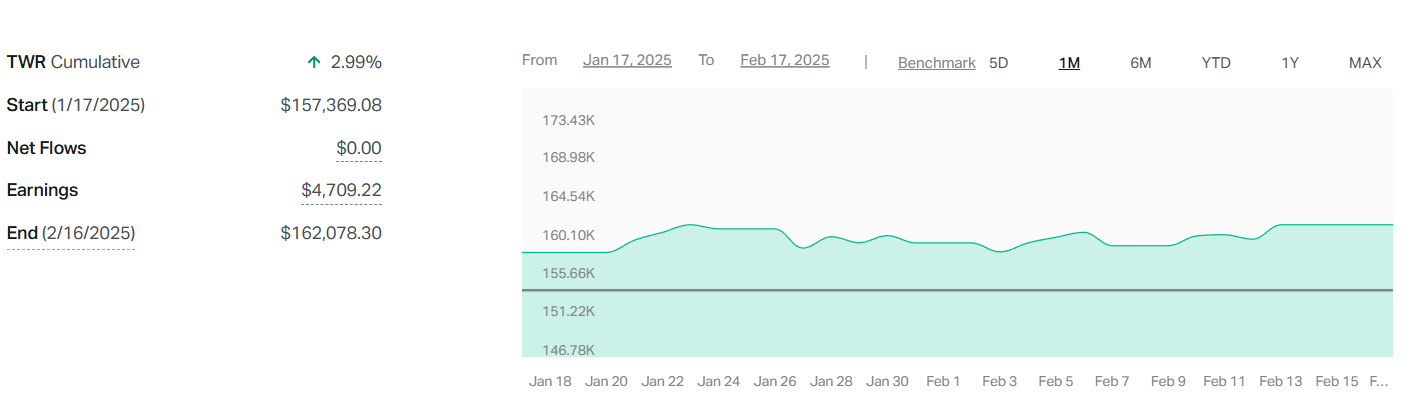

Once the portfolio is in place, we continue to monitor its progress, keeping you informed of new opportunities as part of our ongoing service.

Our job isn’t finished yet – What’s next?

After creating the perfect-fit portfolio, we assess debt reduction opportunities to accelerate our clients’ path to financial independence.

Learn more here.