Our Philosophy

Informal tax management underserves clients. A qualified tax professional paired with well-structured wealth management tools has a place in every plan.

How do we help our clients reduce tax burden over time?

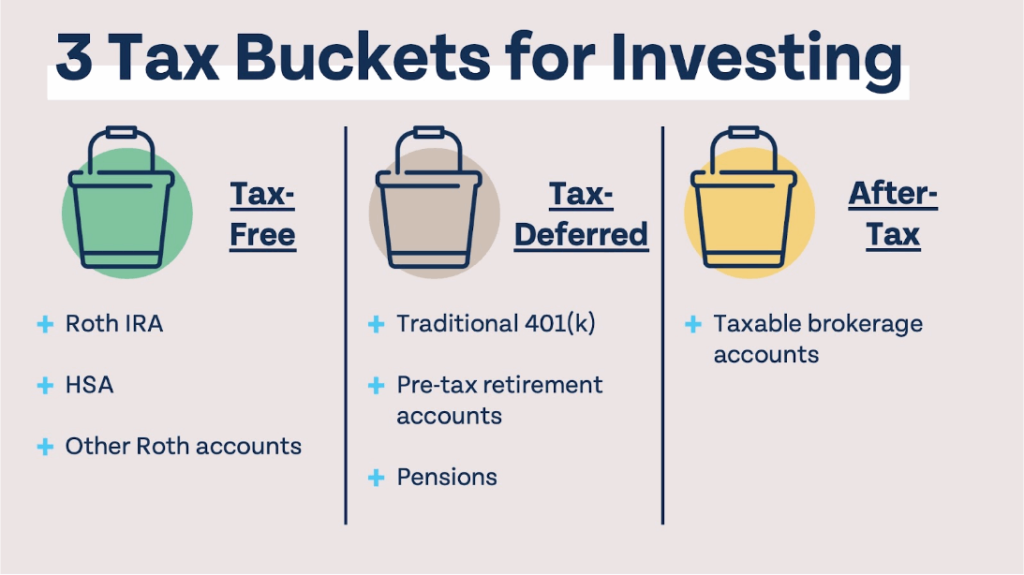

We implement and manage investment accounts with varying tax structures to give clients flexibility in how and when they pay taxes.

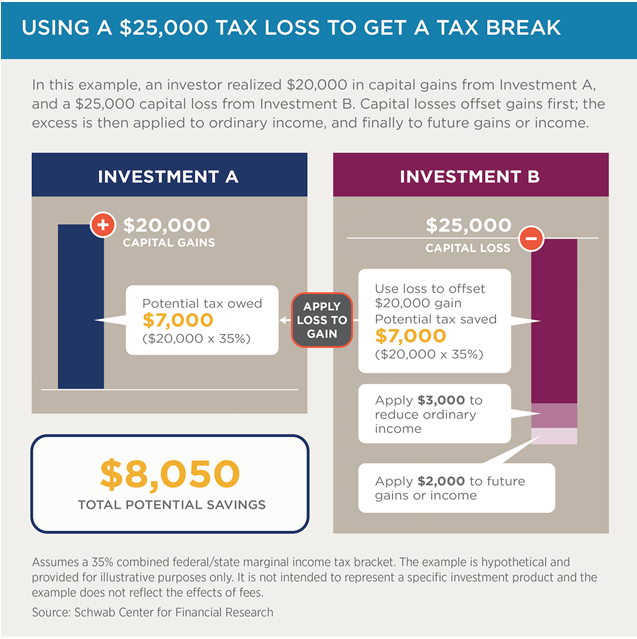

We practice tax-loss harvesting to generate tax benefits for our clients. We diversify client investments while generating tax benefits that can be used immediately, and for future filings.

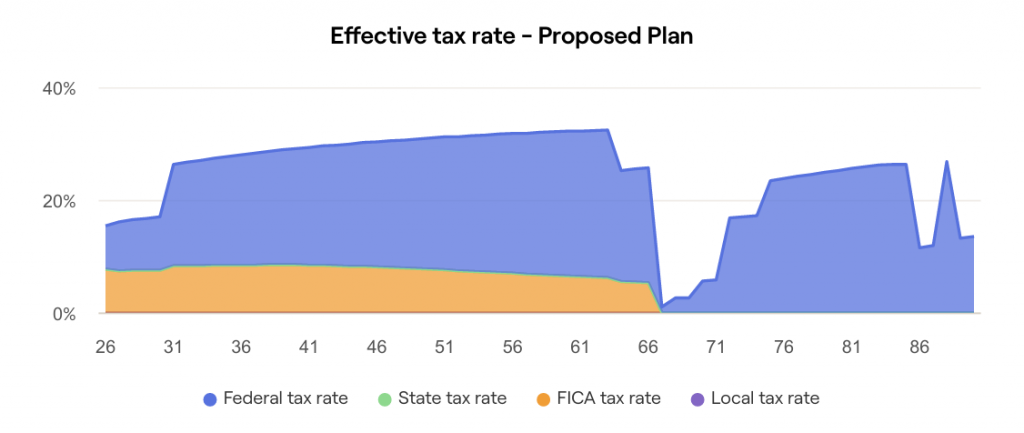

We analyze year-by-year net effective federal taxes during retirement to develop the ideal strategy for maximizing income while minimizing taxes throughout your retirement.

Our job is not done yet – What’s next?

Once we have developed a ongoing tax strategy we assess educational needs for our clients, their children, and their grandchildren.

Learn more here.