Our Philosophy

Responsible debt management starts with an understanding of its sharp nature. Debt can help jumpstart a business or buy a family home. However, If mishandled or inefficiently managed, it can lead to a client’s financial derailment.

How do we help our clients reduce debt over time?

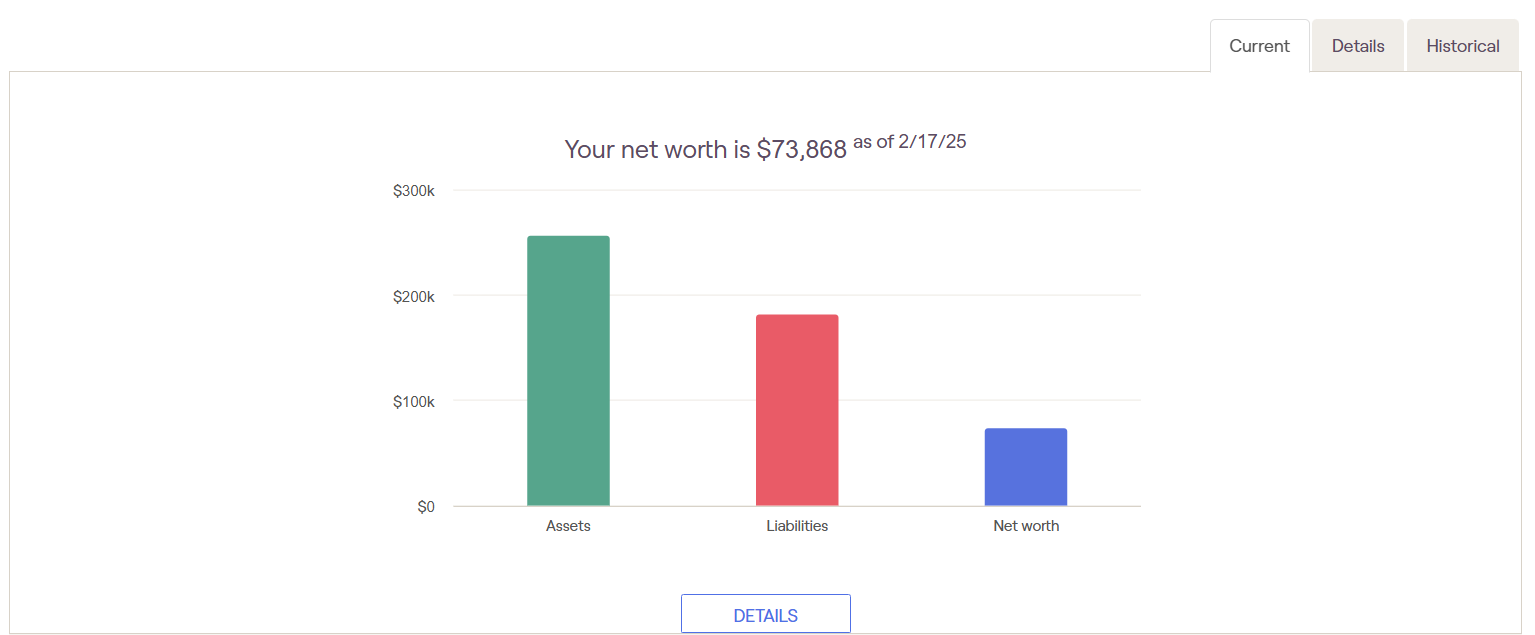

We assess each client’s net worth annually to track their debt progress.

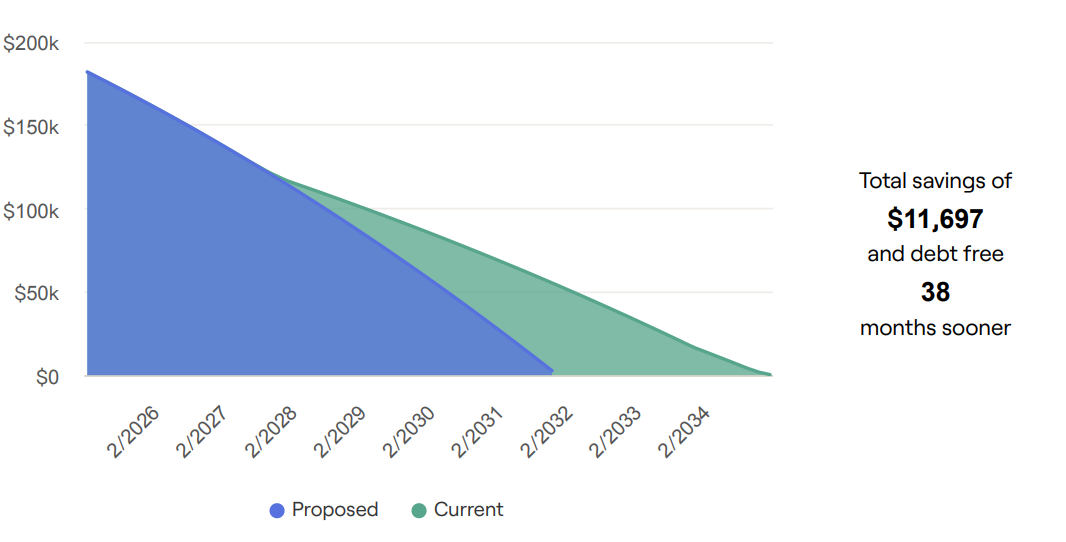

We analyze all debt information to help you implement the most effective paydown strategy, freeing up cash flow and minimizing interest paid.

Our job is still not done – What’s next?

Once we have identified the most effective way to manage client debt, we assess potential tax mitigation opportunities.

Learn more here.