Our Philosophy

After a client has established a path to financial independence, we love helping clients give the gift of education to their children and grandchildren.

How do we help clients achieve their educational funding goals?

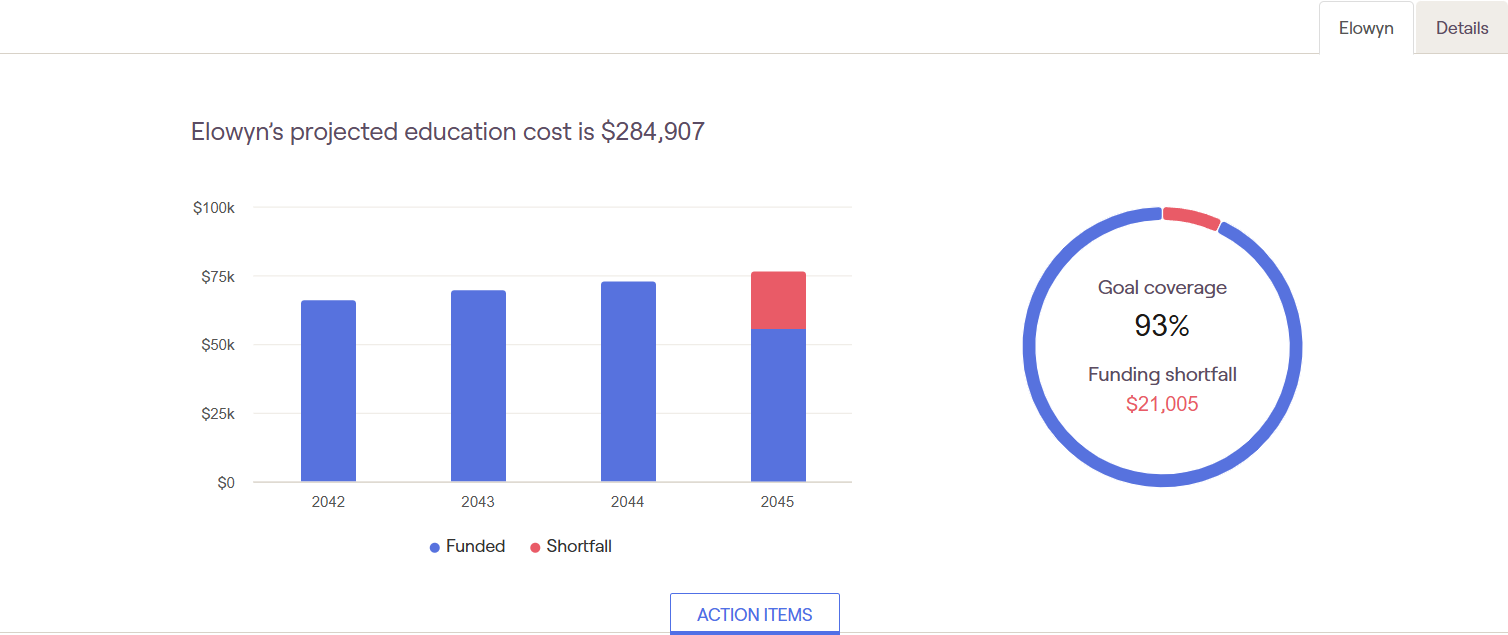

We start by ensuring that each child and grandchild has a customized education plan as part of their family’s greater financial plan.

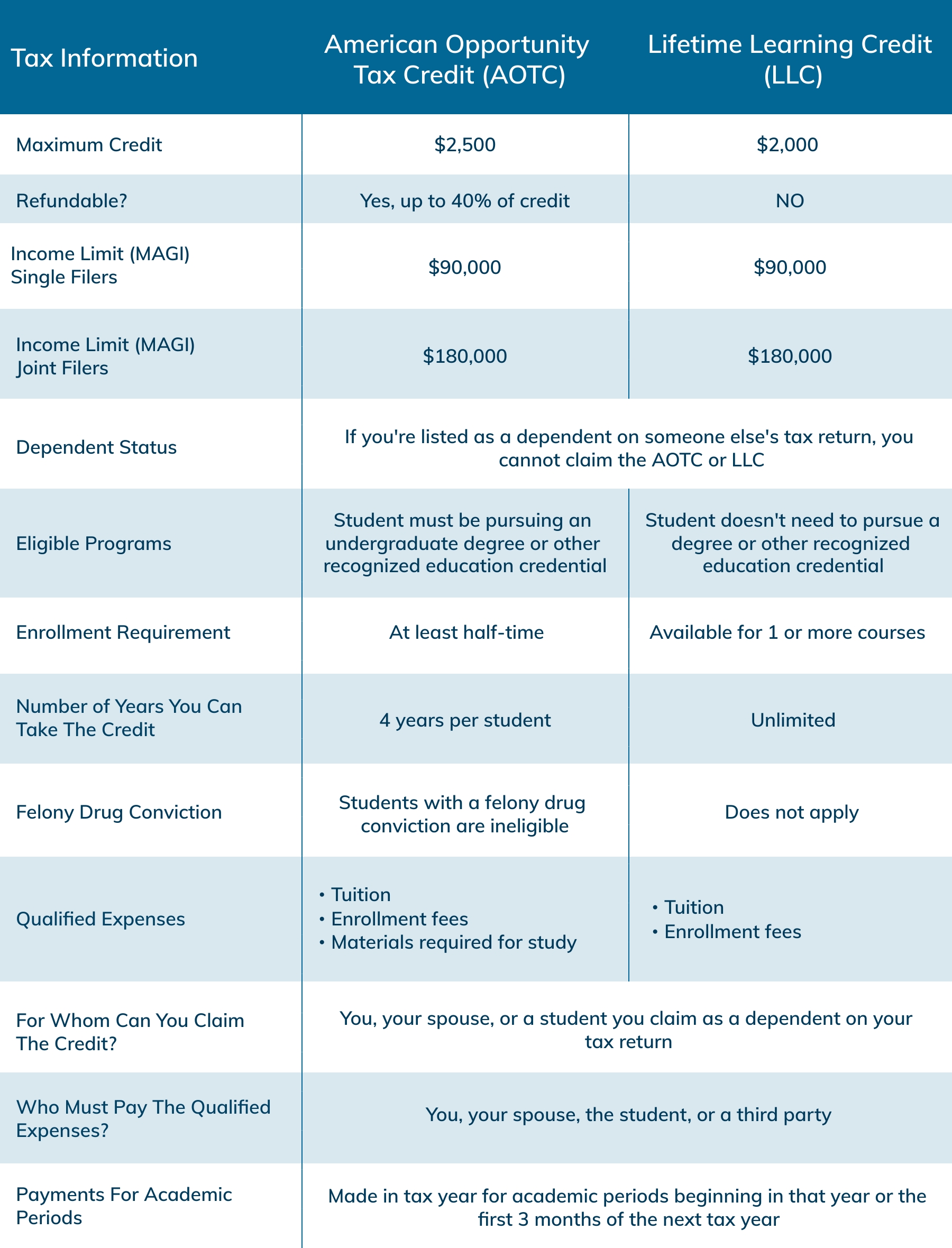

Once the funding goals are established, we educate clients about the tax benefits available to support educational expenses. We also guide them on funding strategies for education investment accounts.

A tailored funding plan reduces the cost of education, enabling the family to benefit from the gift of quality education. Through effective tax planning, our clients may qualify for educational tax credits and accounts they might not otherwise access.

Education plan developed – What’s next?

Once our clients’ educational funding plan is in place, our clients naturally start conversations about what they want to do for their children and other heirs. The last step in our process is to establish an inheritance plan for the benefit of our clients and their heirs.

Learn more here.